Source: BDO

Published: December 1, 2020

Market Perspectives

- 2020 has been a year of rapid change across the

globe. - For the investment world, objectively

understanding this change is essential. - A trustworthy indicator for us has always been

the status of corporate earnings. When coupled with valuations, the health of

the economy, and in turn financial markets, can be appraised. - With the 3rd quarter earnings season

largely behind us and investors shifting focus to the always economically

important holiday season and the ongoing recovery in 2021, we dive deeper into

the status of the corporate profit environment.

“We’ve learned and struggled for a few years here

figuring out how to make a decent phone…PC guys are not going to just figure

this out. They’re not going to just walk in.” – Ed Colligan, CEO of Palm in

2006

Roughly 14 years ago, in November 2006, Palm, Motorola,

Nokia, and Blackberry dominated the mobile world. Earnings for Palm during the

September quarter were $355mm, up 28%, and the company steered towards strong profitability

and revenue growth for the upcoming year on robust sales of the Treo. At one

point, Palm commanded a market valuation of over $50 billion. As many now know,

2007 would represent the beginning of the end for Palm, with the introduction

of iPhones and the release of Android (the first commercial Android phone

arrived in 2008).

More than most times in recent memory, 2020 has demonstrated

that the world no longer takes decades to evolve. Some of these changes are

happening at warp speed. The re-engineering of the mobile universe arguably

began in the late 1990s as the “car phone” migrated to giant handsets and

slowly towards more portable phones such as the Motorola Razor “flip phone.”

Ultimately, smart phones like Palm emerged, only to be eclipsed by the iPhone

and Samsung’s various models.

Today, technology continues to change the economic

landscape. For most of us, “having a Zoom call” was simply not a thing prior to

March of this year. Now it is embedded in our vocabulary. Entire portions of our

economy are changing, seemingly overnight. The point of this messaging is to

refocus on process in a rapidly changing world. Our focus lies on several key

points:

- Understand the past

- Analyze the present

- Look to the future

These lessons help most investors to frame the investment

universe. With these in mind, we dive into S&P 500 earnings season and take

another look at valuations of various asset classes around the globe. Examining

earnings allows us to reference all three of these points, while evaluating

valuations provides us an opportunity to analyze what expectations are already

embedded in market prices.

Understanding

the past

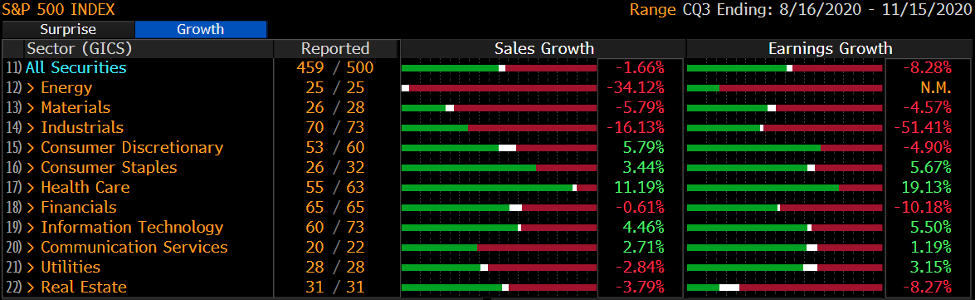

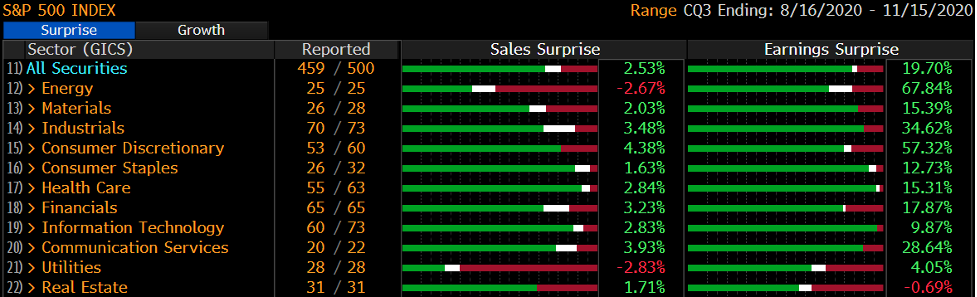

With three quarters of 2020 in the books, it has been a tale of two markets (maybe three). Most companies entered 2020 in a relatively strong position, which continued until late February. At that point, the pandemic’s impact began hitting sales and ultimately profits for many sectors. From March through mid-May, the world virtually shut down for various segments of the economy, and the effect on earnings was severe. Once things began re-opening, many sectors began recovering. This is where we stand at the end of Q3 (Sept 30). As we have discussed many times, some areas of the economy have benefitted from the work from home/stay at home trends. However, a broader recovery is still underway. The first chart below shows Q3 sales and earnings on an absolute growth basis. With most of the S&P having reported quarterly results (459 out of 500 companies), earnings shrank by 8.3% and sales declined by 1.7%.

More interestingly, these reported numbers dramatically outperformed expectations with earnings surprising analysts by +19.7% and sales by +2.5%. In other words, the pessimism from the investment world turned out to be overdone.

Analyzing the Present

The next

question of course is to determine what is going on right now. The chart below

includes various comments about the current environment by CEOs from their conference

calls:

Management Q3 Earnings Commentary

| Darden Restaurants CEO Eugene I. Lee | “Restaurants that had some level of dining capacity for the entire quarter, averaged more than $75,000 in weekly sales, retaining nearly 80% of their last year sales…We made a strategic decision to focus on adjusting our cost structure in order to generate strong cash flows, while making the appropriate investments in our businesses.” |

| Uber CEO Dara Khosrowshahi | “I'd say the environment is constructive. Generally, in certain markets, and the U.S. being an example, as the markets come back, we're actually in more of an under-supply position than an oversupply position as these markets come back.” |

| Delta Airlines CEO Ed Bastian | “To see a meaningful step-up in demand from here, we'll need business travel to further improve, local quarantines to end, and international restrictions to lift. That will only come with widespread advances by the medical community and offices reopening which many expect will start to happen in the first half of next year.” |

| Bank of America CEO Brian T. Moynihan | “What our data continues to suggest is that we are seeing a return to the fundamentals of a generally sound underlying economy, but we won't get there until we fully address the health care crisis and its associated effects.” |

| Amazon CFO Brian T. Olsavsky | “Our Q3 results largely reflect the continuation of demand trends we saw when we exited the second quarter with strong demand and sales growth across our major product categories globally.” |

| Microsoft CFO Amy Hood | “As digital transformation accelerates, and our sales teams and partners continue to execute well in serving customers, our high-value solutions should drive full-year double-digit revenue growth in our commercial segments, even in a challenging and competitive environment.” |

Source:

Bloomberg, Earnings Conference Call Transcripts

As you can see from the commentary above, CEO’s are mixed

with some segments of the economy still struggling. Overall, the tone from

these earnings calls was more constructive than the prior quarter calls, where

far more uncertainty was expressed. One common takeaway from companies hit

hardest by COVID (travel, leisure) is that there was significant cost cutting

and expense rationalization over the past few months to survive the pandemic.

This has set up many of these companies to potentially see strong earnings

boosts when demand does return.

Looking to the

Future

Normally, companies have a decent handle on how business is

doing and where things are headed with a reasonable degree of precision. Right

now, the crystal ball is somewhat cloudier, with future government policy (i.e.

stimulus) up in the air, COVID cases surging (and therefore the risk of a

pandemic-driven economic slowdown occurring again), various vaccines in the

final stages of development, and vaccine distribution reasonably soon. When

looking beyond the immediate challenges, consensus estimates seem to suggest

that going forward, earnings and sales growth will continue the recovery trend.

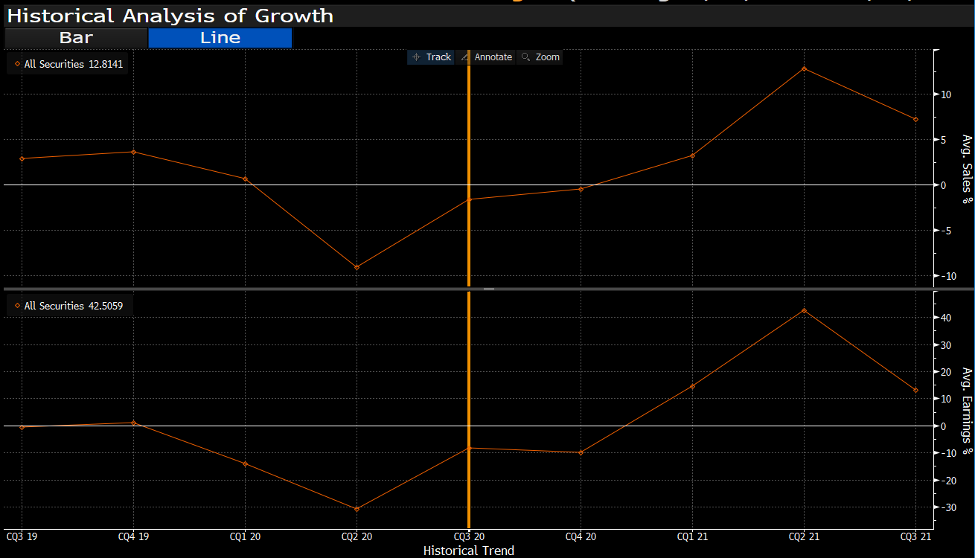

The chart below shows sales growth expectations on the top portion with earnings growth on the bottom. The vertical line in the middle represents the current quarter (Q3 2020 ended 9/30). The points to the right of this are future expectations and the points to the left are history. You can see that consensus is for negative earnings and sales growth to continue into Q4 (although improved from Q3) and slowly rise beyond that into 2021.

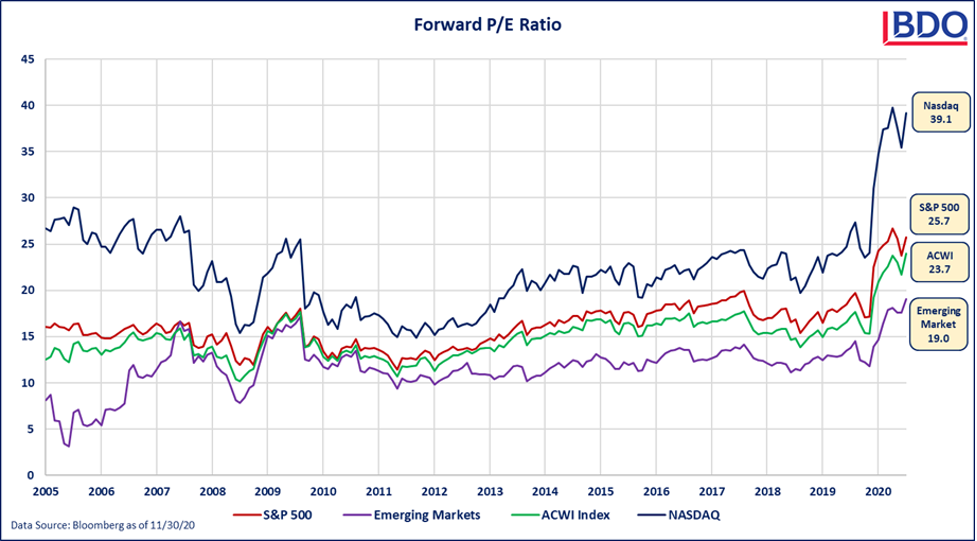

With these factors in mind, it is important to take note of valuations which tend to be forward looking in nature. Domestic markets, particularly large-cap stocks, appear to be towards the upper part of the range of historical valuations. In other words, the earnings improvement, as well as the economic improvement, are at least in part anticipated by the markets. The below chart shows the rise of forward-looking price/earnings ratio for 4 major indices (Nasdaq, S&P 500, MSCI All Country World Index, and MSCI Emerging Markets).

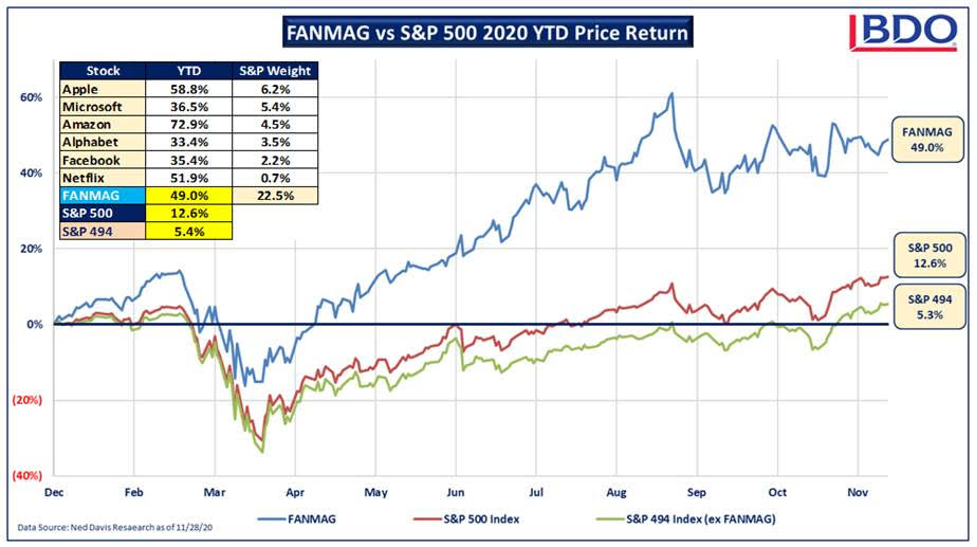

As referenced earlier, the mega-cap technology focused stocks have benefitted from the more virtual world that has been created in 2020. This trend has pushed the broader indices to appear expensive because of the large weighting in the S&P 500 (and even more so in Nasdaq).

As we have so often referenced over the course of 2020, a

process driven approach becomes even more important during extreme times.

Critical factors such as earnings growth help provides clarity in an unclear

world. A long-term view remains embedded in rationale investing. With these

tools, and many others, we remain focused on meeting the goals and objectives

of the families we serve.

BDO Wealth Advisors, LLC is a Registered Investment

Advisor dedicated to providing clients with unbiased, personal financial

advice. Working in partnership with our clients, our wealth management team

helps organize, enhance, manage, and preserve wealth through sound financial

strategies. This information is provided by BDO Wealth Advisors for the

personal use of our clients and friends. It should not be construed as

personalized investment, tax, or legal advice. Information compiled from Ned

Davis Research and additional third-parties. Please be sure to consult your CPA

or attorney before taking any actions that may have tax consequences and

contact BDO Wealth regarding any investment decisions. Every investment

strategy has the potential for profit or loss.

For questions regarding this research, kindly contact Larry Miao (smiao@bdo.com)