Author: Market Analysis by BDO Wealth Advisors Investment Committee

Published: January 2021

- With a new year upon us, and changes imminent on the political front, we revisit the concept of how having a “diversified” portfolio can reduce equity risk while not sacrificing portfolio returns.

- In this Market Perspectives, we present a refresher on diversification. Specifically, we focus on the potential benefits and considerations of having exposure to Emerging Market equities in a diversified portfolio.

- The evolving global landscape may provide the potential for attractive long-term opportunities in Emerging Market equities.

“The beauty of diversification is

it’s about as close as you can get to a free lunch in investing.” – Barry

Ritholtz

The BDO Wealth investment process includes diversification as one of our core principles. Portfolio diversification is an investment concept which theorizes that investment risk can be reduced by allocating investment dollars across various countries, asset classes, market capitalizations, sectors, and industries with the goal of reducing overall portfolio risk through such varied exposures. Each of these asset classes may react differently to global/market factors and trends, major domestic/international events and changes to economic conditions.

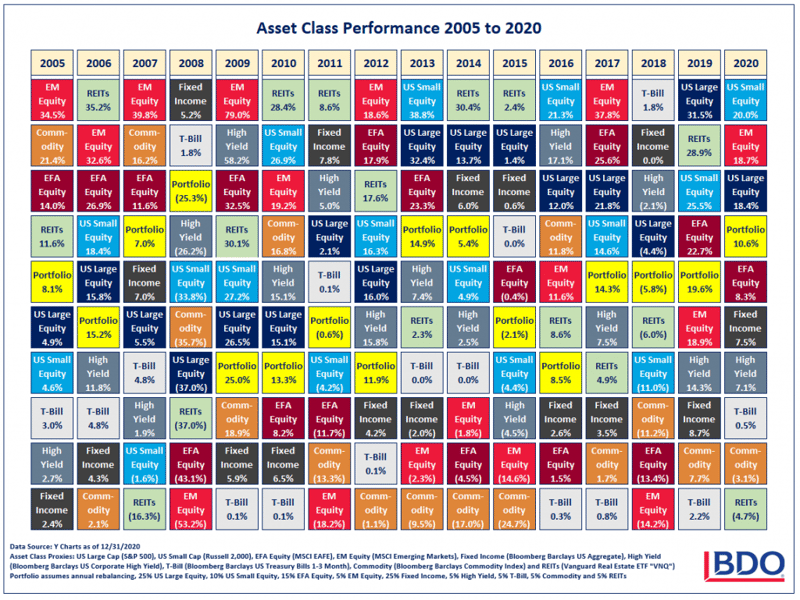

The chart below demonstrates that a balanced portfolio comprised of asset classes that are not perfectly correlated lowers volatility (i.e. risk, portfolio fluctuations) over time. The yellow boxes in the chart highlight the value of a diversified portfolio with asset class performance over the last 15 years. The best performing asset class changes almost on an annual basis. Attempting to predict the best performing asset class in the coming year is a difficult process. Investors tend to chase performance by buying the prior year’s winners as opposed to staying diversified with exposure to a wide range of asset classes. Through the process of diversification, portfolio outcomes tend to be more stable. As you will note below, the balanced portfolio (yellow boxes) tends to provide a smoother path with less dispersion over time than each of the individual asset classes.

The

strong performance of the Emerging Markets (“EM”) asset class has been a

relatively hot topic in recent months for investors, forcing a reevaluation of

many underweighted portfolios. Major shifts in the global economy, changes in

trend growth rates and population growth trends in recent years have brought

the focus back to EM due to an attractive mix of:

- Long-term growth rates in GDP and attractive fundamentals

- Rising middle class demographics in large Emerging Markets such as India and China

- Technological innovation in a world that increasingly is shifting from brick and mortar to online retailing

- Near-term economic recovery leadership

- Discounted relative valuations of EM vs. the developed world equity markets

What

are Emerging Markets?

- “Emerging Markets” is a term that refers to an international economy that is expected to experience strong economic growth with the trade-off of a higher level of uncertainty. Generally speaking, these are markets that are expected to experience significant foreign and local investment and are attracting capital to fuel such growth. This leads to higher levels of employment and a rising standard of living.

- The risks inherent in this growth include currency stability, political uncertainty, and market volatility amongst others.

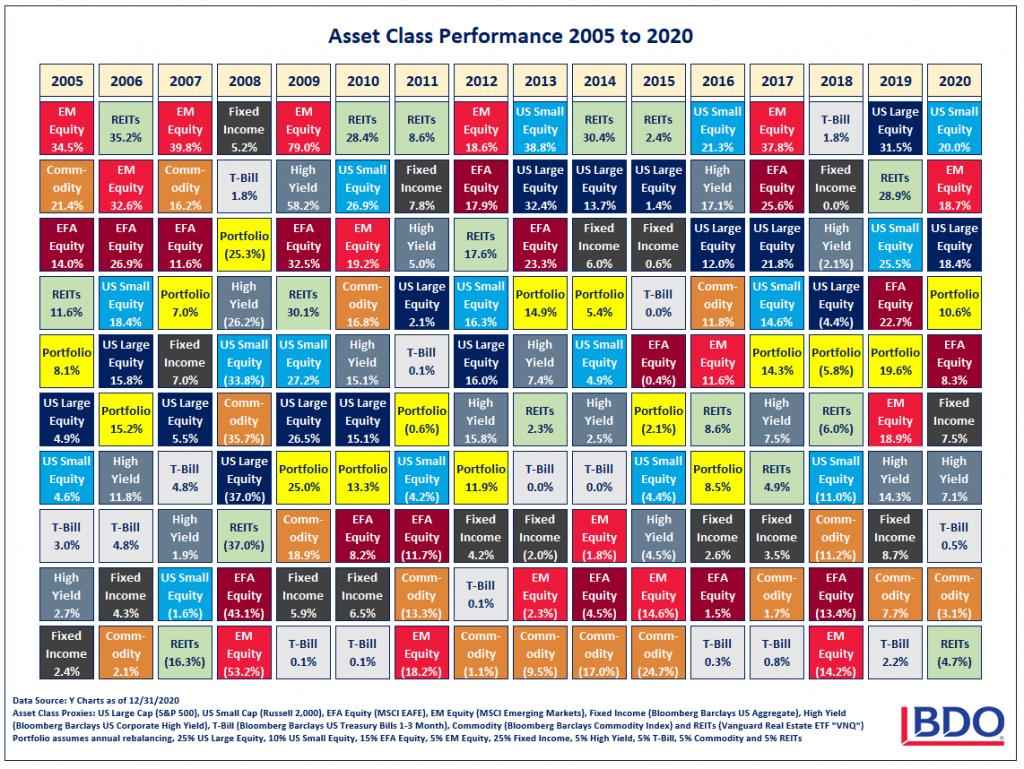

- EM indices includes an approximate breakdown by country and sector exposure as seen in the following charts:

What

are some of the positive and negative characteristics of the asset class?

Positive investment traits of EM investments

typically include:

- High rates of economic growth

- Positive demographic trends due to expected increase in standard of living

- Favorable government policies which may lead to capital inflows

- Portfolio diversification due to varied risk factors

Risks inherent in investing in the EM asset

class:

- Concerns with political instability in developing countries

- Supply-demand shocks

- Immature infrastructure and regulatory backdrops

- Exchange rate and Credit risk

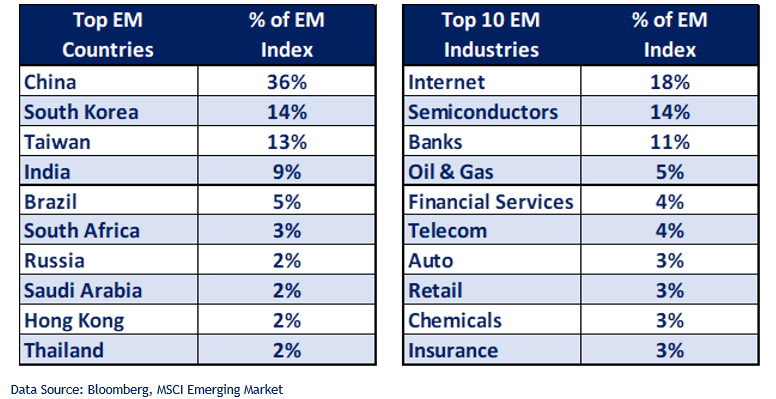

With

these characteristics in mind, we would highlight several other important

factors. Twenty years ago, Emerging Markets around the globe were approximately

40% of global Gross Domestic Product (“GDP”). Today these markets represent

more than 60% of global GDP as shown in the following. This is primarily due to

the faster growth rates as seen below:

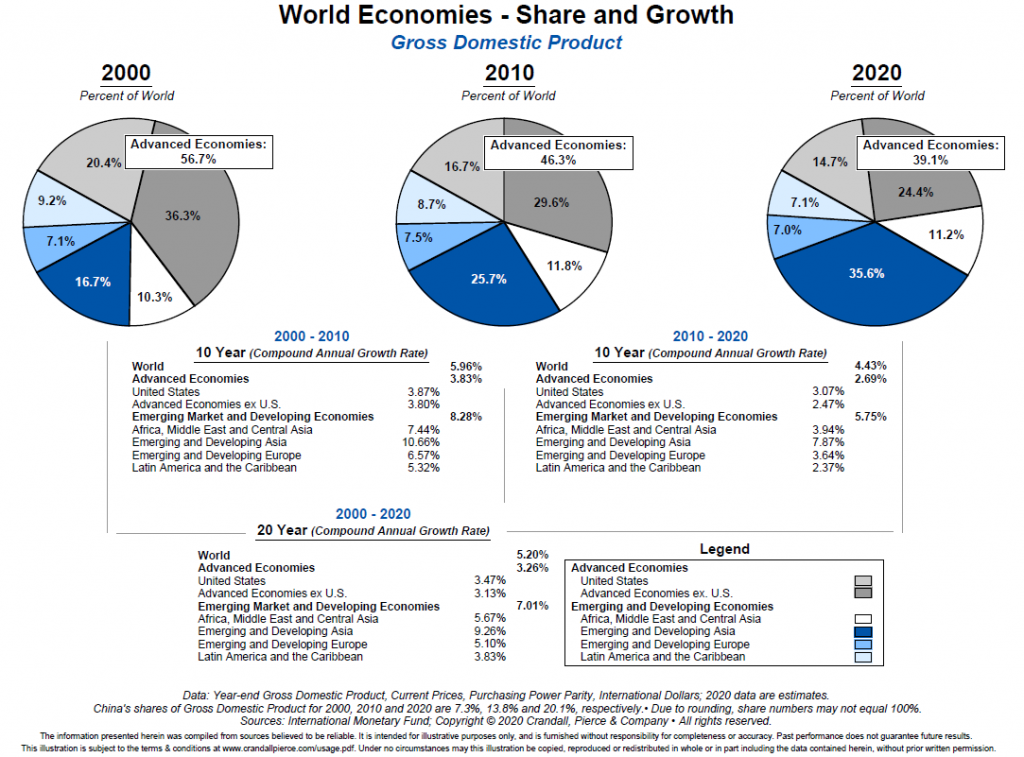

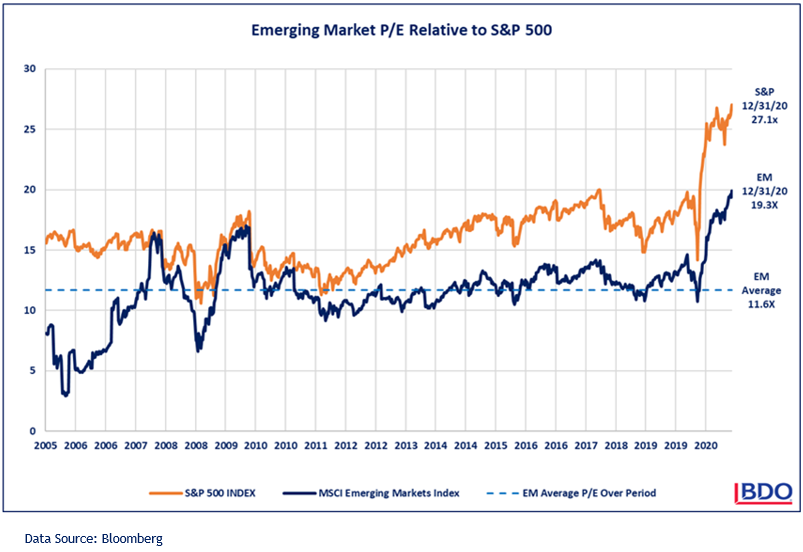

In addition to the

attractive growth metrics, and growing global importance, on average, EM stocks

trade at a discount to the developed world. P/E ratios are the price of the

security divided by the earnings. The ratio can change through “price” (i.e.

“P”) movement or through “earnings” (i.e. “E”) growth/declines (or both). As

markets rallied towards the latter half of 2020, P/E accelerated as the

investment community was slower to alter the earnings estimates. Nonetheless,

EM markets remained discounted vs. the S&P 500 in 2020, reaching near the

widest levels seen in over 15 years. While the gap has narrowed somewhat, the

discount remains wide. The following chart demonstrates the valuation gap:

For

long-term investors, a diversified portfolio comprised of asset classes with

varied risk factors driving performance will likely provide attractive

risk/reward characteristics. Emerging Markets, while volatile, fit squarely

into a disciplined investment portfolio management strategy by altering the

risk metrics which drive performance. As we confront the highly uncertain

investment environment of 2021, we continue to focus on diversification which

served investors so well during the volatility of 2020. Like many, we welcome

the start of 2021 and we look forward to speaking to you in the near future.

Please reach out with any questions.

For any

questions regarding this resource, kindly contact Larry Miao, smiao@bdo.com